Table of Contents

ToggleSecrets Of Accident Claims Against GEICO Revealed

It’s no secret that the GEICO insurance company is notorious for battling legitimate claims to avoid payouts. But did you know that there are secrets to achieving a successful car accident claim against GEICO?

You should always keep the following information in mind when dealing with a GEICO accident claim:

Secret 1: Never provide a recorded statement to an insurance adjuster.

You should never provide a recorded statement to an insurance adjuster. These statements can be used against you to minimize the compensation you receive for your injuries.

Adjusters are trained to ask leading questions that will put the blame on you and your actions. Even if you were completely blameless in the accident that led to your claim, the GEICO adjuster will still look for loopholes to pay you less than you deserve.

Before speaking with a GEICO adjuster, consult an experienced car accident lawyer who can advise you on the best course of action.

Secret 2: Accurately calculating damages after a car accident is a complicated task.

Another secret to getting a fair settlement from GEICO involves accurately calculating your damages. This is often a challenging task that requires accounting for more than just medical bills and repair costs.

Accident victims often lose money because they can’t go to work. They may also have psychological damages like pain and suffering and be unable to enjoy certain aspects of life that they could before the accident.

You should keep track of all expenses related to the accident in order to secure reasonable compensation.

However, calculating the “real” costs of your damages is challenging, and it requires legal expertise to ensure that nothing is left out.

Secret 3: GEICO adjusters will make a low initial offer to protect their bottom line.

GEICO insurance adjusters will often make a low initial offer to protect their bottom line. GEICO is a business whose ultimate goal is to protect its profits.

The first settlement offer is typically very low and does not reflect the full value of your claim. This is where having a car accident lawyer can be helpful.

Secret 4: It may be necessary to file a personal injury lawsuit against GEICO.

An adjuster may tell you early on that they are “investigating” your claim, which might make you think they are on your side.

However, what they are really doing is looking for reasons to deny your claim or offer you a low settlement. In many cases, it may be necessary to file a personal injury lawsuit against GEICO to get the compensation you deserve.

Secret 5: GEICO may replace a victim’s total medical expenses with their own estimation of “usual and customary charges.”

If you’ve been in a car accident and sought medical treatment, GEICO may try to replace your medical expenses with their own estimation of “usual and customary charges” for the treatments you received. This estimation may be biased and much lower than what is actually owed.

Secret 6: GEICO may delay payment or deny valid claims altogether.

Another way that GEICO tries to keep from paying out substantial settlements is by delaying payment or denying valid claims altogether. They may require you to fill out countless amounts of paperwork, which is a tactic to cause you to miss deadlines.

Additionally, they may try to discredit your medical records or exert pressure on you to settle quickly before you’ve had a chance to assess the extent of your injuries.

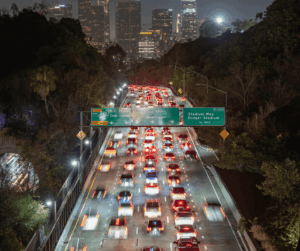

A Los Angeles Personal Injury Lawyer Can Handle Your Insurance Claim and Fight for Fair Compensation

Navigating insurance claims and lawsuits can be difficult. With an experienced personal injury attorney by your side, you can level the playing field and ensure that you get the compensation you deserve.

By understanding the secrets of accident claims against GEICO, you can avoid common pitfalls and fight for your rights.