Table of Contents

ToggleKey Takeaway

Q: Why can’t I trust my insurance company after a crash?

A: Insurers aim to minimize payouts by pushing quick, low settlements that ignore future medical costs, lost wages, and full damages.

Q: How do they trick victims into accepting less?

A: They exploit incomplete records, twist your statements against you, and downplay non-economic damages like pain, emotional distress, and lost earning capacity.

Q: What’s the smartest move to protect my claim?

A: Document everything thoroughly, avoid giving statements without advice, and contact MYLAWCOMPANY.com immediately for a lawyer who levels the playing field against insurer tactics.

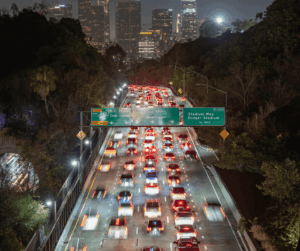

After a car accident or other serious injury in Los Angeles, most people turn to their insurance company with the expectation that they will be taken care of. After all, you pay premiums month after month for the very purpose of having financial protection when the unexpected happens.

But here’s the truth most accident victims don’t realize until it’s too late: insurance companies are not on your side. Their primary goal is to minimize payouts and protect their bottom line—not to ensure you receive the full and fair compensation you deserve.

At MYLAWCOMPANY.com, we’ve seen firsthand how insurers use tactics designed to reduce claim values, pressure victims into early settlements, and even deny valid claims outright. To protect yourself, it’s critical to know what your insurance company won’t tell you about personal injury claims in California.

Insurance Companies Want to Settle Fast

One of the most common strategies insurers use is to push for a quick settlement. They know that in the days and weeks after an accident, victims are often overwhelmed with medical bills, repair costs, and lost income. By dangling a fast check in front of you, they hope you’ll accept far less than your case is actually worth.

Here’s what they won’t tell you:

- Your injuries may cost more long-term. Initial settlement offers rarely account for ongoing physical therapy, future surgeries, or chronic pain that may develop later.

- Lost wages add up. If you’re unable to work for weeks or months, you could lose significant income that an early settlement won’t cover.

- Once you accept, it’s final. In nearly all cases, signing a settlement agreement means giving up your right to pursue additional compensation—even if new injuries or complications appear later.

The best way to protect yourself is to never accept the first offer without fully understanding the scope of your damages. An experienced lawyer can calculate the true value of your claim and ensure you don’t leave money on the table.

Documentation is Everything

If you want to maximize your settlement, documentation is your strongest weapon. Insurance adjusters will seize on any gaps in your records as a reason to lower your payout.

Essential documentation includes:

- Medical records – These establish a clear link between the accident and your injuries, as well as the severity of your condition.

- Accident photos and videos – Images of the crash scene, damaged vehicles, road conditions, and visible injuries provide undeniable evidence.

- Witness statements – Independent witnesses often carry more weight than the drivers involved. Their accounts can confirm how the accident happened.

- Police reports – Official documentation creates a neutral record that insurers can’t easily dismiss.

Without strong evidence, your claim becomes a matter of your word against the insurance company’s interests. That’s why it’s critical to be thorough from the very beginning—and why working with an attorney helps ensure nothing is overlooked.

Statements Can Be Used Against You

After an accident, an insurance adjuster will often call you quickly, asking for “just a few details” or a “recorded statement.” They may sound friendly, but remember: everything you say can and will be used to reduce your claim.

Common pitfalls include:

- Admitting fault – Even a simple apology like “I’m sorry” can be twisted into an admission of liability.

- Speculating about injuries – Saying “I feel fine” or “I don’t think I’m hurt” may be used against you later if symptoms develop.

- Guessing details – If you’re unsure about something, don’t speculate. Inconsistencies can be used to challenge your credibility.

Instead, keep your communications brief, factual, and limited. Better yet, let your lawyer handle communication with the insurance company. This ensures you don’t accidentally say something that weakens your case.

Settlements Often Don’t Cover All Expenses

What most accident victims don’t realize until they see the bills pile up is that insurance settlements rarely account for the full scope of damages.

Here are some of the costs insurers often minimize or ignore:

- Future medical care – Surgeries, ongoing physical therapy, rehabilitation, or treatment for chronic pain.

- Lost earning capacity – If your injuries prevent you from returning to the same job or career, your long-term income potential may be drastically reduced.

- Emotional and psychological damages – Anxiety, PTSD, depression, and loss of enjoyment of life are real consequences of serious accidents.

- Household services – If you can no longer perform household tasks like childcare, cleaning, or maintenance, those costs can be included in your claim.

Without an attorney calculating the full scope of your damages, it’s easy to underestimate your needs—and accept a settlement that falls far short of what you require to rebuild your life.

Why Legal Representation Levels the Playing Field

Insurance companies have teams of adjusters and attorneys trained to minimize payouts. On your own, it’s easy to be overwhelmed by their tactics. By working with an experienced Los Angeles personal injury lawyer, you gain an advocate who:

- Knows the law and your rights under California’s personal injury statutes.

- Understands the true value of your claim and won’t settle for less.

- Can negotiate aggressively with insurers to secure a fair settlement.

- Is ready to take your case to court if the insurance company refuses to be reasonable.

Simply put, a lawyer ensures you are not at the mercy of the insurance company’s strategies.

Final Thoughts

Insurance companies rarely explain the full picture when it comes to personal injury claims. They push for fast settlements, exploit incomplete documentation, and use your own words against you—all while offering payouts that don’t come close to covering the true costs of your injuries.

By knowing what to watch for and working with an experienced attorney, you can protect yourself from being shortchanged. Don’t let the insurance company dictate the value of your recovery.

Don’t let insurance companies shortchange you. Call MYLAWCOMPANY.com today for expert guidance and maximize your personal injury claim in Los Angeles.